pay indiana business taxes online

If the business cannot locate. SBAgovs Business Licenses and Permits Search Tool allows you to.

How To Register For A Sales Tax Permit In Indiana Taxvalet

Please contact us at 8008916499 and request a Tax Liability Status Auditor if you have an account in pending status.

. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME. All businesses in Indiana must file and pay their sales and. After the tax bill is paid in full the business must file a REG-1 form that is mailed to the business.

The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding. INtax is Indianas free online tool to manage business tax obligations for Indiana retail sales withholding out-of-state sales and more. DOR Tax Forms Online access to download and print DOR tax.

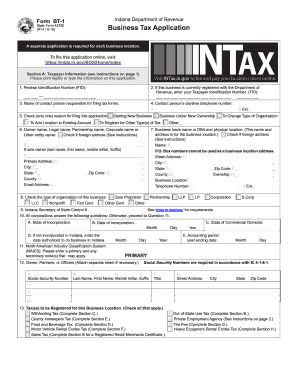

Paying by e-check should notify their banking institution that. Indiana Small Business Development Center. Business Tax Application form BT-1.

Cookies are required to use this site. Set up necessary business tax accounts List what the business does List which taxes will be collected and paid Complete an application for each. If a business does not pay its tax liability the RRMC will expire.

Prepare to file and pay your Indiana business taxes. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME. Pay an Indiana Tax return through INTIME.

Indiana Business Taxes for LLCs. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding. Indiana county resident and nonresident income tax rates are available via Department Notice 1.

Business taxes are a fact of life and your LLC will need to pay a variety of taxes to both the state and federal governments. INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales. Department of Administration - Procurement Division.

The option to make a. This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. Indianas one-stop resource for registering and managing your business and ensuring it complies with state laws and regulations.

Any employees will also need to. Indiana businesses have to pay taxes at the state and federal levels. If you have an account or would like to create one or if you.

Prepare to file and pay your Indiana business taxes You can file and pay with the. Make an individual return or extension payment without logging in to INTIME. After the tax bill is paid in full the business must file a REG-1 form that is mailed to the business.

Pay Your Property Taxes. Your browser appears to have cookies disabled. County Rates Available Online.

You can file and pay with the Indiana DOR online using the Indiana Taxpayer Information Management Engine INTIME.

How Do State And Local Sales Taxes Work Tax Policy Center

Tax Claim Indiana County Pennsylvania

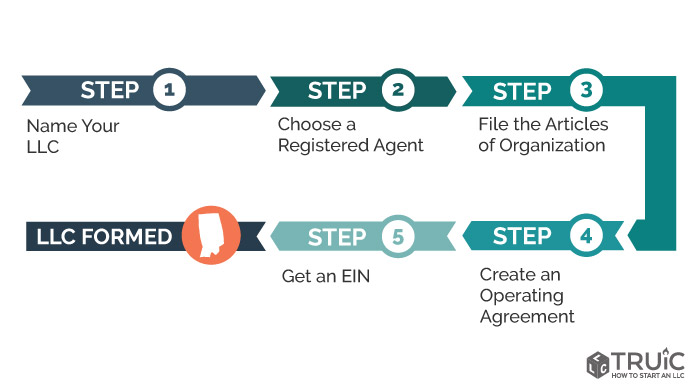

Llc Indiana How To Start An Llc In Indiana Truic

Bt 1 Indiana Fill Out And Sign Printable Pdf Template Signnow

Guide And Calculator 2022 Indiana Sales Tax Taxjar

Indiana State Tax Information Support

Dor Owe State Taxes Here Are Your Payment Options

How To Pay Sales Tax For Small Business 6 Step Guide Chart

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

:max_bytes(150000):strip_icc()/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-b2584d2f80b043d0814fca81c1b1fecf.jpg)

How To Budget For Taxes As A Freelancer

2021 State Business Tax Climate Index Tax Foundation

Indiana State Taxes 2021 Income And Sales Tax Rates Bankrate

Indiana Annual Report Filing File Online Today Zenbusiness Inc

Business Income Taxes In Indiana Who Pays

Business Income Taxes In Indiana Who Pays

Tax Credit Online Marketplace Creates Connections For More Deals Inside Indiana Business

30 Important Tax Forms Terms And Dates That Every Small Business Owner Should Know Article